Determining a Stock Value

Pricing Stock

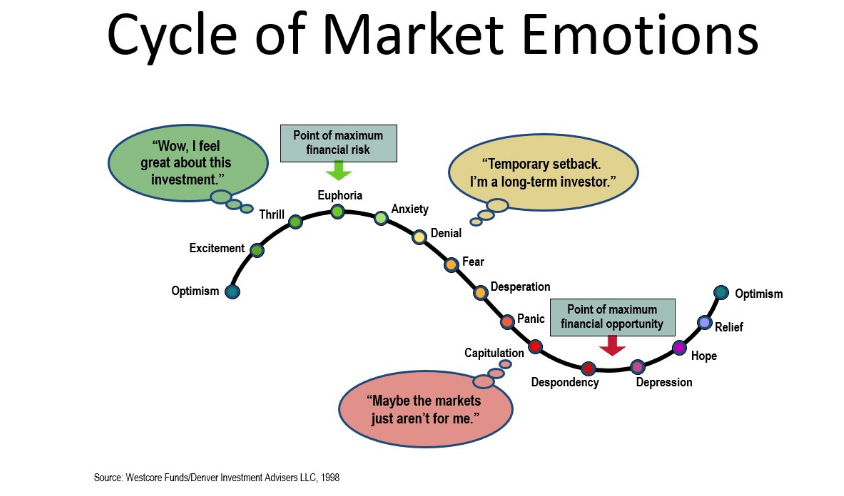

There are always going to be both buyers and sellers when it comes to trading stock. The price at which the sale is made reflects the stock market’s current consensus valuation of those shares. However, as we’ve learned the hard way, the market is often incorrect. Indeed, given the extreme volatility of stock values and the continuous intra-day swings, the market is often incorrect.

About 98% of the time, planes are not flying directly between New York and Los Angeles, a distance of 3,500 miles. The pilot is constantly adjusting the course of the jet to keep it heading in the right direction, which is toward Los Angeles. Those changes are almost often imperceptible to the travelers. The value of a stock remains unchanged. Every fractional change in a stock’s price is an attempt by the market to maintain the price going in the right direction, toward the stock’s worth.

However, unlike when an aircraft reaches its destination, stocks might easily keep going beyond their value and go in a different direction. The stock market may go on forever. (Except in the case of a company’s acquisition or bankruptcy. When a company files for bankruptcy or is acquired, the stock price will fall to zero or the takeover price, respectively, and remain there until the event is finished. However, the path of a stock price is often unending. A company’s worth will fluctuate over time, even if it doesn’t do so very often. Therefore, when the price of a stock approaches its value, the volatility and uncertainty of the price are amplified by the moving target that is the value of the underlying firm.

True Worth

It’s possible to see the stock price at any time. But how much is a share of stock really worth?

A firm’s worth may be defined as the present value, in today’s dollars, of all of the cash the company is expected to create for its shareholders over the course of its lifetime. It’s simple to pinpoint the influencing factors:

1) cash flows expected in the future

2) when exactly those monetary infusions will occur

3) the concept of temporal worth of money

An investor may quickly determine an enterprise’s true worth if he has total clarity in three key factors. Even if the expected cash flows in the future were to stay same, that value would change. It would still be vulnerable to shifts in the time value of money element, which depends on interest rates and inflation, which would have a negative impact on the value of that firm. The worth of any fixed income source changes when interest rates shift.

Valuation

A company with no chance of ever making money for its owners is not worth having. Simple. Many who worship at the altar of the Internet failed to learn this lesson. People who bought into the dot-com bubble were more concerned with the paper value of their stocks than with the actual companies that those stocks represented. They mistakenly thought that the stock market determined a company’s worth. They reasoned that a company’s long-term success was unimportant if they could simply predict which stocks would be hot next week (or month, or year).

There is no relationship between supply and demand and stock prices. In the short term, the market is a voting machine, tallying the votes of buyers and sellers, as Ben Graham predicted. However, the market acts as a scale in the long run, determining how much each stock transaction is worth.