Elevate Your Retirement with Strategic Investment Synergy

Simplify Your Retirement Investing with Our Tailored Solutions

Steer Your Retirement Towards Success

Wealth preservation made easy

Shield your retirement portfolio from the uncertainties of public market fluctuations. Safeguard your investments by diversifying into private assets with lower correlation, ensuring stability and resilience.

Accelerate Long-Term Growth

Leverage the extended investment horizon of your retirement account to pursue higher risk-adjusted returns through alternative investments. Allow compounding to work in your favor, driving steady growth and wealth accumulation over time.

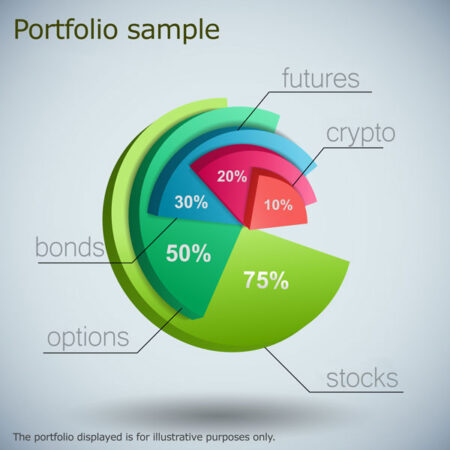

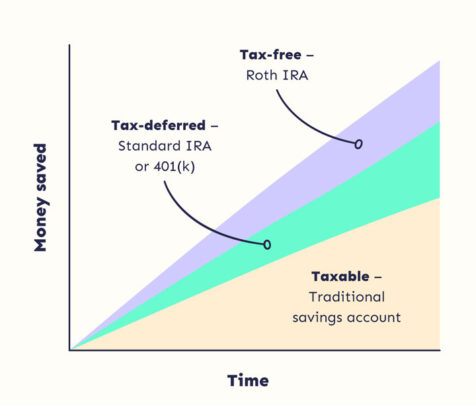

Maximize your returns

Optimize your earnings by incorporating alternative investments like equities, bonds, and futures into your retirement account. Enjoy the advantage of tax-deferred compounding, allowing your investments to grow more efficiently without immediate tax implications upon maturity.

- Protect Your Wealth

-

Wealth preservation made easy

Shield your retirement portfolio from the uncertainties of public market fluctuations. Safeguard your investments by diversifying into private assets with lower correlation, ensuring stability and resilience.

- Compound Long-term Growth

-

Accelerate Long-Term Growth

Leverage the extended investment horizon of your retirement account to pursue higher risk-adjusted returns through alternative investments. Allow compounding to work in your favor, driving steady growth and wealth accumulation over time.

- Maximize Your Returns

-

Maximize your returns

Optimize your earnings by incorporating alternative investments like equities, bonds, and futures into your retirement account. Enjoy the advantage of tax-deferred compounding, allowing your investments to grow more efficiently without immediate tax implications upon maturity.