The Fear of Missing Out and How to Conquer It

The Science

Fear of missing out (FOMO) has biological origins as a defense against danger. The amygdala, a little but powerful region of the brain, is where it all begins. And it’s so potent that “neurons there are associated in fear conditioning, a process by which we might learn to dread and avoid something,” says Regina Bailey, ThoughtCo’s resident biology expert.

There is scientific evidence that FOMO developed as a survival mechanism. It all starts in the amygdala, a small but powerful part of the brain. Moreover, “neurons there are connected with fear conditioning, a process by which we could learn to hate and avoid something,” as explained by Regina Bailey, ThoughtCo’s resident biology expert.

Applications to Trading Psychology

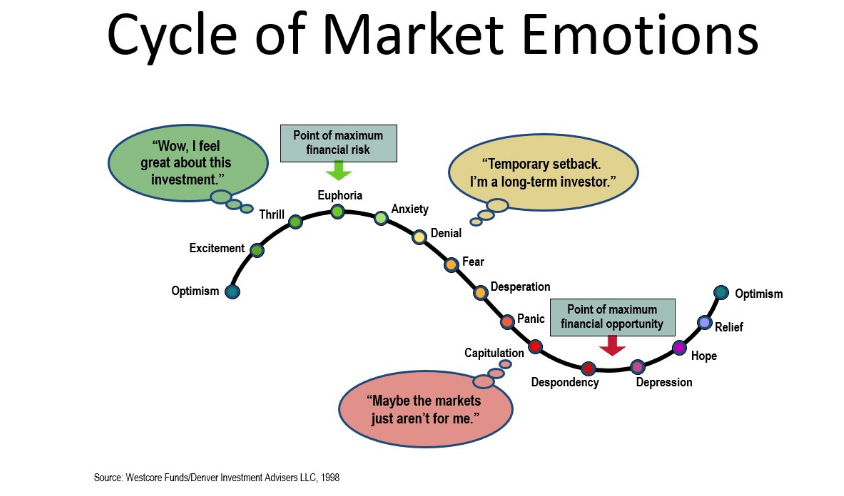

For traders, the fear of missing out (FOMO) is more about the potential loss of income than it is about physical danger. Most of us are either short on cash or just don’t have enough. In this way, the fear of missing out (FOMO)-amygdala mechanism is triggered by the prospect of losing it or failing to make more of it.

These are some of the most frequent situations in the trading world that might cause traders to experience fear of missing out (FOMO):

- Impatience — You can’t sit around and wait for the setup to give you the ideal buying indications. Concern that it will escape your control. Maybe you’re looking forward to the novelty of entering the room before everyone else. In either case, you’re putting more faith in your worries than in the stock itself.

- No Plans/Rules – If you have no other guidelines except “get in now!” in trades, you will likely engage in erratic trading behavior based only on hope rather than any kind of solid plan.

- Information overload — The constant barrage of “get rich fast” schemes, penny stock scams, and fear-mongering politics has you feeling like you can’t take any more information in (e.g. buy gold coins now to protect yourself from economic meltdowns)

- Social media influences — A few people you know, others you know of, and maybe even strangers have all made money by purchasing a certain growth stock. You, however, are not among them.

- Bad risk management — When you’ve already lost a lot of money on a bad bet, it might be tempting to “double down” in the hopes of making it all back by increasing your wager.

- Expectations too much —When you’ve already lost a lot of money on a bad bet, it might be tempting to “double down” in the hopes of making it all back by increasing your wager.

Several stocks in 2017 made everyone feel like they were missing out (FOMO), most notably on social media. DRYS, MNKD, and HMNY were a few examples of such stocks.

DRYS moved from $4 bucks to $100 in the span of 4 days. That’s a 2,400% return. On the fourth day of the move, the FOMO thought-process was basically this:

In only 4 days, DRYS went from being worth $4 to being worth $100. In financial terms, it equates to a return of 2,400%. This is the primary line of thinking that was driving the fear of missing out on day four of the move:

Tell me the truth: Are you excited with the stock’s first price movement? You’re experiencing FOMO if this is the case. We recommend that you take a seat. Inhale deeply. And you may want to think about picking up a straitjacket just in case.

As for DRYS, it promptly lost all of its gains over the next three days. By that, I mean absolutely everything. Those who invested around the peak lost a lot of money. The market is always equitable, by the way. There is always a consequence for doing anything.

How Do We Conquer FOMO?

What are our options for putting an end to this feeling of impending doom? How can we hope to eradicate it if it has been so deeply ingrained in the human brain and behavior? My conversations with seasoned traders provided me with both encouraging and discouraging perspectives on this topic.

It’s usually bad news first, unfortunately. We can never get away from the FEELING of FOMO.

The greatest and poorest traders experience FOMO at around the same times and in similarly effective ways. The silver lining is that you can decide how you respond to it. Even the worst traders must respond to the change. Pro traders may safely disregard it. You can earn a lot of money by just ignoring your FOMO-crazed ideas.

Their individual methods, as described to me, are as follows:

- Develop a trading plan or strategy – Failing to plan is planning to fail; that is the ancient business adage. It’s a cliche, but those who are really committed to their achievement, especially traders, should treat those words as if they were carved in stone. This is where stricly adhering to a set of trading rules such as our winning 0-Gravity Cash Flow System strategy helps keep you out of trouble and always on the winning side.

- Avoid distractions — Everything that’s vying for your attention, from the latest headlines to your social media feeds. Sincerely, no one else cares more

- Accepting the loss early – It’s important to foresee and accept a potential loss in a deal. I mean, really acknowledge it. Realize that this exchange isn’t necessary for your success. To generate consistent profits, rather than a one-off windfall, you’ll need a succession of smart deals.

- Stop changing your mind mid-trade — I found this one very challenging when I initially began working on it. Your stock price may eventually fall even as others in the market rise. But keep in mind that your trade is still active so long as it is in the safe zone between your stop loss and your profit objective. Stay out of it, and don’t undermine yourself. No action is required on your part. Before making the deal, you should have completed all necessary steps.

- Avoid distractions — Everything that’s vying for your attention, from the latest headlines to your social media feeds. Sincerely, no one else cares more about your achievement than you do. All profits and losses incurred as a result of your trading decisions are your own responsibility. If you suffer a loss, accept responsibility for it and investigate its cause. Take credit for your success; it means you’re doing something right.

- Planning your trades ahead of time — It takes time to arrange a trade. It takes many days for solid trades to give suitable entrances, and the finest transactions might take weeks or months. Tracking chart trends in advance is essential. Then, BE PATIENT for an opportunity that fulfills your entrance requirements to reveal itself (i.e. above-average volume, MACD crossover, overcoming a resistance level, etc.). Never enter a trade unless and until you get the appropriate signal(s).

- Entering a trade last minute — In many communities, “chase” is a serious issue. When buying stocks, the IBD advises never going more than five percent over your starting price. Don’t purchase more than 2% above entry, per our advice. In many cases, a pullback in price to re-test a breakthrough point is consistent with the market’s “natural nature.” For the most part, transactions don’t immediately rise. To attract more customers, they require free time and space to provide quality work at affordable pricing. If you got in at a higher price and the stock is now dropping, there’s no need to put yourself through the agony of keeping it. It’s easy to avoid having to chase by just avoiding the need to chase in the first place. Make smart purchases the first time around. Incorporate price notifications into your routine. If you are “chasing,” you probably didn’t use the first tactic (above).

- Copy Trading — Instead of trading yourself, you can set your portfolio to copy trades from well performing trading groups such as 0SPX‘s 0-Gravity strategy which takes all the emotional aspect from your hands.